Due to increased cost of construction materials and labor, it has become increasingly important for all Club Owners to review their property insurance coverage. Whether you are leasing your space or own your building, the cost to replace your improvements and structure have increased significantly this year.

What Is Co-Insurance?

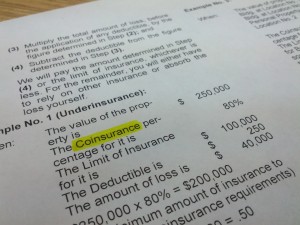

There is a little-known endorsement on virtually every property insurance policy called Coinsurance Clause. This clause is more or less a “keep the customer honest” document that requires the policy holder to insure the full replacement value of your property or at least within 80% to 90% of that number. It can be a little complicated, but the failure to insure your property to the proper replacement cost values can result in a coinsurance penalty. This penalty can be significant in the event of a loss…even a partial loss.

For example: You have a building or improvement replacement value of $3,000,000 at today’s cost but your insurance coverage is only $2,000,000. You sustain significant damage to your club due to a roof collapse of $500,000. Since you have $2M in property insurance you think that you are fine. However, the adjuster confirms that the replacement value of your club is at $3M. Since coinsurance requires you to insure at that amount, you only have 2/3 of that amount covered. To make the math simple, your claim would then be settled on that same 2/3 valuation. So instead of getting a check for $500K, you are penalized 33%. You now have a deductible (penalty) of $165,000 for this loss.

How Do I Evaluate Replacement Costs?

Replacement cost valuation of your property is the responsibility of the policy holder, not the insurance company. Since building costs can vary significantly depending upon type of construction and area of the country, we recommend that you consult with a local contractor to determine the actual cost to rebuild your gym in today’s market. I guarantee most club owners are underinsured and risk being subjected to this Coinsurance Clause penalty. Keep in mind that “market value” and “replacement value” can be drastically different values.

When Should I Look at Increasing my Property Coverage Cost?

You do not need to wait until your renewal to increase your property coverage. We recommend that you take a hard look at what it would cost to rebuild your gym from the ground up and then contact your agent to make any adjustments to your coverage.

If you don’t have an agent, can’t get a hold of them, or just want another opinion, feel free to reach out to my team here. We can help answer your questions if you are a Gym Operator looking for some advice on coverage. If you rent your Health Club’s building, we also provide a FREE Lease Review service as a starting guide to deciphering which policies you are responsible for vs. which ones the landlord should be covering.