Insurance isn’t the sexiest topic. In fact, many people would rather not think about it at all – until they need it, that is. When the unthinkable happens, and you suffer a loss and have to submit a claim to your insurance company, you start thinking about your coverage again. And if it was a less-than-stellar claim, you may be feeling the hit from filing the claim.

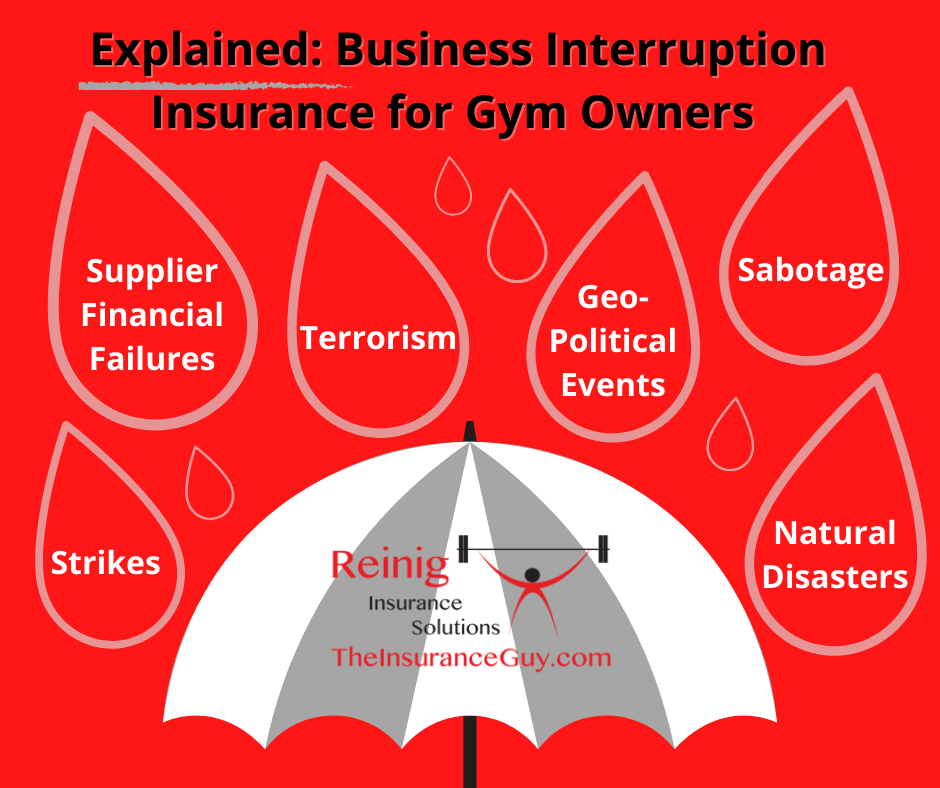

But having the right insurance coverage in place is critical for your business, especially in these uncertain days. Your gym faces lots of risks every day, from the threat of storm damage to your building to an injury claim from a member. Gym closures are another area of potential loss to your business – what happens if your gym has to close due to another pandemic shutdown or another reason out of your control?

Not having insurance coverage for shutdowns and slowdowns can be risky, especially as the world continues to change around us. The fitness business is dynamic, and your changing needs call for updated coverage.

Learn more about Business Interruption Insurance for gyms in this handy guide, then call us for more help with your business interruption coverage and other commercial insurance needs!

Business Interruption Insurance for Gyms

Business Interruption Insurance, also called Business Income Insurance, is commercial insurance coverage that can help your business during shutdown periods. The coverage is designed to cover a loss of income suffered by your business due to a shutdown or slowdown of operations caused by a covered loss type. Only about 40% of small businesses purchase business interruption coverage, though, according to the NAIC.

The coverage can be helpful for small business owners of all kinds. If a covered loss happens, Business Interruption insurance can cover lost revenue your business would have made if it was open, as well as help to pay ongoing operating expenses like lease payments, electric bills, and loan payments. The coverage helps with relocation expenses to a new facility if yours can’t be used and pays for training your employees on new machines or equipment at a different location. Other business expenses like payroll and taxes can also be covered.

Why Didn’t Business Interruption Insurance Help Gym Owners During COVID?

Unfortunately for many gym owners – and many business owners in general – many business interruption policies did not cover shutdowns caused by the pandemic lockdown. This is because the pandemic was not considered a covered loss type, so coverage for ensuing damages wasn’t covered. A direct physical loss is generally required to trigger business income coverage.

Pandemic exclusions exist on many commercial insurance policies for a few key reasons. Pandemics are widespread and difficult to predict –insurance is not generally meant to cover the type of systemic risk. For other types of systemic risks, the government has formed federal programs to cover these risks – like the Terrorism Risk Insurance Act. A similar program could be structured for pandemic risks.

What Are “Pandemic Exclusions” and How are these Evolving as COVID Unfolds

Many lawsuits have been filed by businesses that were denied coverage under their Business Interruption coverage. Courts have dismissed or denied many of these lawsuits, agreeing with insurance companies that no coverage existed because of the pandemic exclusion.

Some Business Interruption policies were written without a pandemic exclusion before COVID-19, but policy language is inevitably changing following the pandemic, so future policies will look different. Business owners who had a policy without the pandemic exclusion have tried to get coverage by claiming the virus exists on physical surfaces at the business, posing an immediate health risk. Still, most of these lawsuits have also been denied.

However, two court cases ruled in favor of businesses – one in North Carolina and the other in Florida. Over 2000 business interruption cases have been filed, and the verdict is still yet to be determined in many of these cases. This could mean other policyholders will be successful in securing coverage, especially if these two cases can be used to set coverage precedents.

What’s Next For Gyms With Business Interruption Losses?

There is more to come with business interruption cases that have been filed. Every state government and the federal government are contending with lawsuits and cases related to denied business interruption claims. If more courts begin ruling in favor of policyholders, it could signal a shift in the way carriers handle the coverage. State governments can impose fines and insist carriers provide coverage if they find carriers have denied claims they should have paid.

Not getting business interruption claims paid can have a devastating affect on gyms. For some it means not being able to keep a valued employee on the payroll, for other it is perhaps not affording essentials such as utilities or equipment upgrades needed to be competitive in the market. For many – 30% of gyms nationwide – it means permanent closure. In many states, gyms were mandated as the first businesses to close and were the last to have restrictions lifted in re-openings.

What’s the GYMS Act and Why are Gym Operators Getting Involved?

Many gym owners are rallying together with legislators to establish a recovery fund for health clubs nationwide called the GYMS Act. If passed, the 30 billion dollar fund would provide grants for fitness industry businesses. This kind of financial relief could help gyms recover not just from the difficulties or this pandemic, but it could mitigate financial losses in the midst of the next crisis. Check out this article to see how you can get involved in the passing of the GYMS Act.

Did you have a business interruption insurance claim denied? Do you need help reviewing your policy and talking through the losses your business suffered through 2020 and 2021? Connect with us to talk more about your unique situation. We’ll review your options and help you understand if you can claim lost revenue or other pandemic-related damages following the forced shutdown.

If you don’t already have Business Interruption Insurance, we can help you find a policy to meet your gym’s needs in the future. Finding the right policy means understanding your current coverage, identifying any gaps, and recommending individualized coverage to best protect your gym. We specialize in this personal touch – call us today for a free review of your current coverage.

How do I Learn More?

Reach out today to speak with our friendly agents about your gym and your Business Interruption Insurance needs. We can help whether you already have coverage and need help understanding your policy or making a claim or if you want to find a Business Income policy that is right for you. Check out our other COVID-19 risk management resources for copies of helpful waivers and forms your gym can use.

The Gym Owner’s Guide to COVID: Vaccinations, Responses and More

Colder weather has brought with it an expected surge of COVID. Your staff and your members are relying on you to make decisions that will

Don’t Get “Scrooge’d” Over: Holiday Risk Management Tips for Gym Owners

When the weather starts to get frosty, you know the holidays are quickly approaching. But while tidings of good cheer for all is a lovely

Risk Management is the Future of Insurance

Introducing: Reinig Risk Management – a REX approved supplier of Risk Management services built to protect you from the unexpected. Our services help to identify